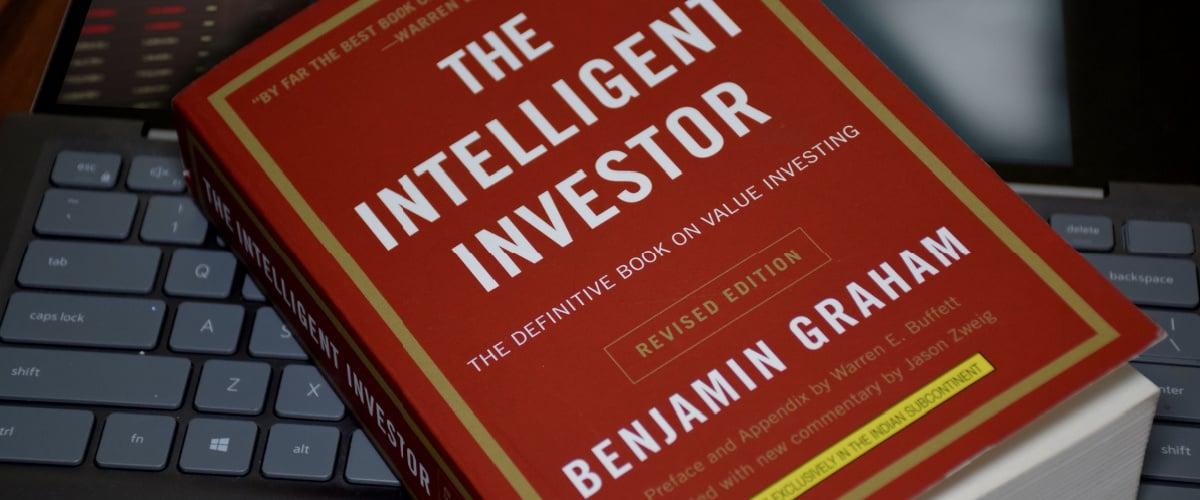

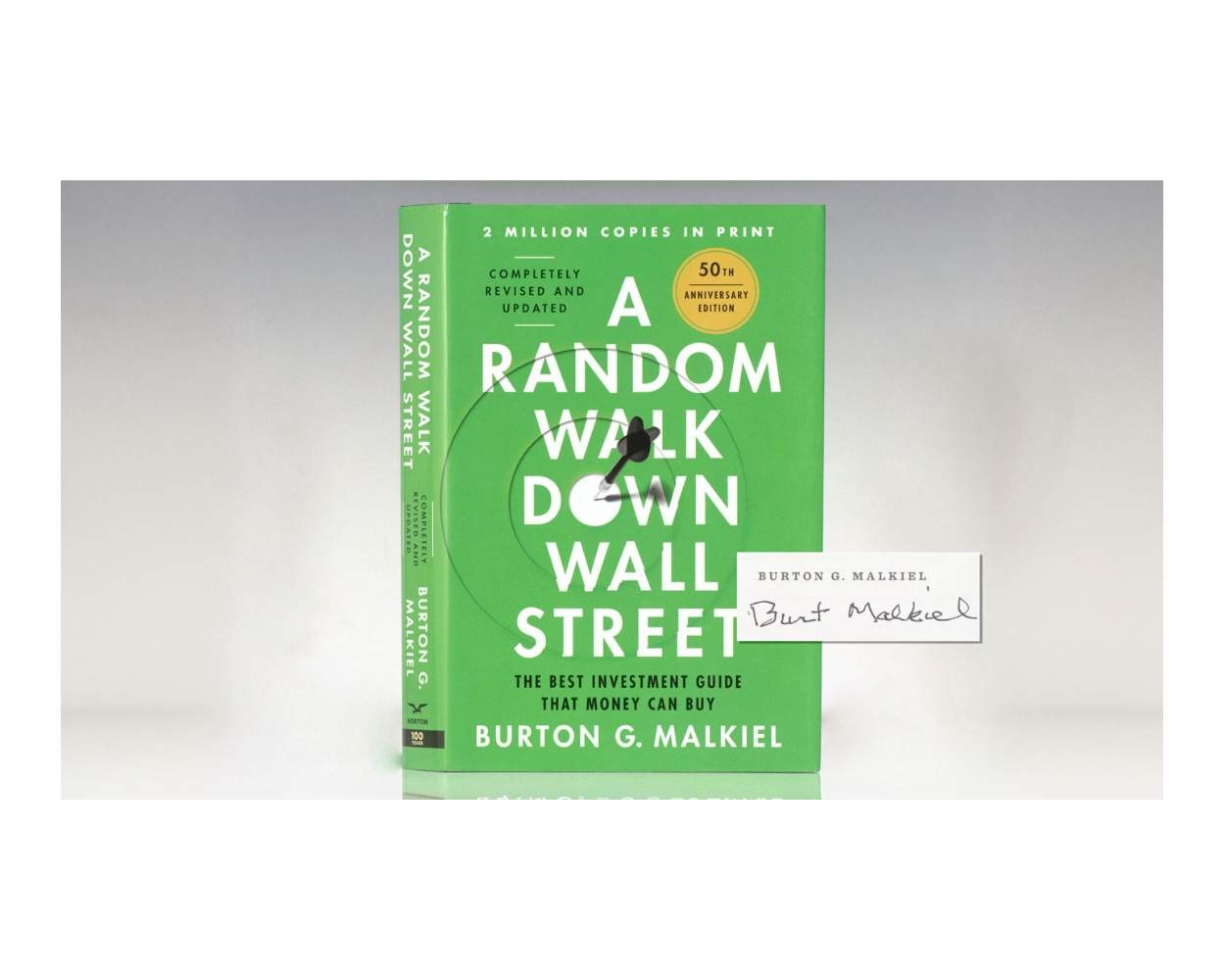

If you’ve been searching for a clear explanation of how stock markets really work—and whether it’s possible to beat them consistently—A Random Walk Down Wall Street by Burton G. Malkiel may be your ideal guide. This personal finance classic introduces the theory of efficient markets, explores various investment strategies, and offers a compelling case for index fund investing.

Quick Overview

- Title: A Random Walk Down Wall Street

- Author: Burton G. Malkiel

- First Published: 1973 (multiple revised editions in later years)

- Main Focus: The efficient market hypothesis (EMH), index fund investing, and why most attempts to time or outsmart the market often fail.

Malkiel’s main argument is that stock prices are inherently unpredictable in the short term—akin to a “random walk.” Consequently, complex stock-picking methods or market timing strategies rarely beat a simple, passive approach over the long haul.

5 Key Takeaways

- Efficient Market Hypothesis (EMH)

- Concept: All known information is already priced into stock values, making it difficult to find “undervalued” gems.

- Why It Matters: It challenges the belief that active investors can frequently beat the market by spotting mispriced securities.

- Random Walk Theory

- Concept: Day-to-day movements in stock prices are unpredictable and follow a random path.

- Why It Matters: Attempts to time the market often lead to lower returns or missed opportunities.

- Index Fund Advantage

- Concept: Low-cost index funds typically outperform most actively managed funds over the long term.

- Why It Matters: Minimizing fees and staying invested consistently can significantly boost overall returns.

- Behavioral Pitfalls

- Concept: Investors are prone to biases like overconfidence, herd mentality, and fear-of-missing-out (FOMO).

- Why It Matters: Being aware of these biases can prevent emotional mistakes, such as panic selling or chasing trends.

- Long-Term Perspective

- Concept: Historically, a diversified portfolio grows over time despite short-term market volatility.

- Why It Matters: Maintaining a focus on the big picture helps investors stay calm during market downturns and reap the benefits of compounding.

Who Should Read “A Random Walk Down Wall Street”?

- Beginners in Investing: If you’re new to the stock market, Malkiel’s breakdown of different investment vehicles is both clear and thorough.

- Passive Investment Enthusiasts: Anyone interested in index funds and buy-and-hold strategies will appreciate the data-backed arguments.

- Skeptics of Get-Rich-Quick Schemes: If you doubt the promises of stock-picking gurus, this book offers a compelling alternative view.

- Seasoned Investors Seeking a Refresher: It never hurts to return to first principles, especially when tempted by new market fads.

Personal Reflection

When I picked up A Random Walk Down Wall Street, I was caught up in the excitement of trying to time the market. Malkiel’s explanation of the efficient market hypothesis and random walk theory was eye-opening. I realized that most of my attempts to “beat” the market weren’t based on solid analysis, but on luck—or worse, speculation. Gradually, I shifted a significant portion of my portfolio into low-cost index funds. This move not only simplified my approach but also helped me avoid stress over daily price swings, focusing instead on steady, long-term growth.

Ready to Dive into Market Mechanics?

If you’re looking for a data-driven argument for a low-cost, passive investing strategy—and want to understand the theories behind it—this classic belongs on your reading list.

Final Thoughts

Decades after its initial publication, A Random Walk Down Wall Street continues to influence investment philosophy worldwide. Burton G. Malkiel’s emphasis on the unpredictability of short-term market moves—and the wisdom of straightforward, long-term strategies—has shaped countless portfolios. If you’re ready to let go of high-pressure stock picking and embrace a more measured, research-backed approach, this book could be the key to a calmer, more successful investment journey.