Setting financial goals is a fundamental step toward building a secure and prosperous future. Whether you want to save for a house, pay off debt, or retire early, having a clear financial plan can transform your aspirations into achievable milestones. This guide will help you understand how to set financial goals and, more importantly, how to achieve them.

At Invettor.com, we are dedicated to providing comprehensive insights into finance and decision-making. Our goal is to empower you with the knowledge and tools to achieve financial freedom and make the most of your money.

1. Why Financial Goals Are Important

Financial goals provide direction and purpose to your money management. They help you:

- Stay focused on your priorities.

- Measure your progress over time.

- Avoid impulsive spending and financial stress.

- Build confidence in your financial future.

2. Types of Financial Goals

Understanding the different types of financial goals can help you create a balanced plan:

- Short-term goals (0-1 year): Examples include saving for a vacation, paying off small debts, or creating an emergency fund.

- Medium-term goals (1-5 years): These might involve saving for a car, starting a business, or paying off student loans.

- Long-term goals (5+ years): Retirement savings, buying a home, or building a wealth portfolio.

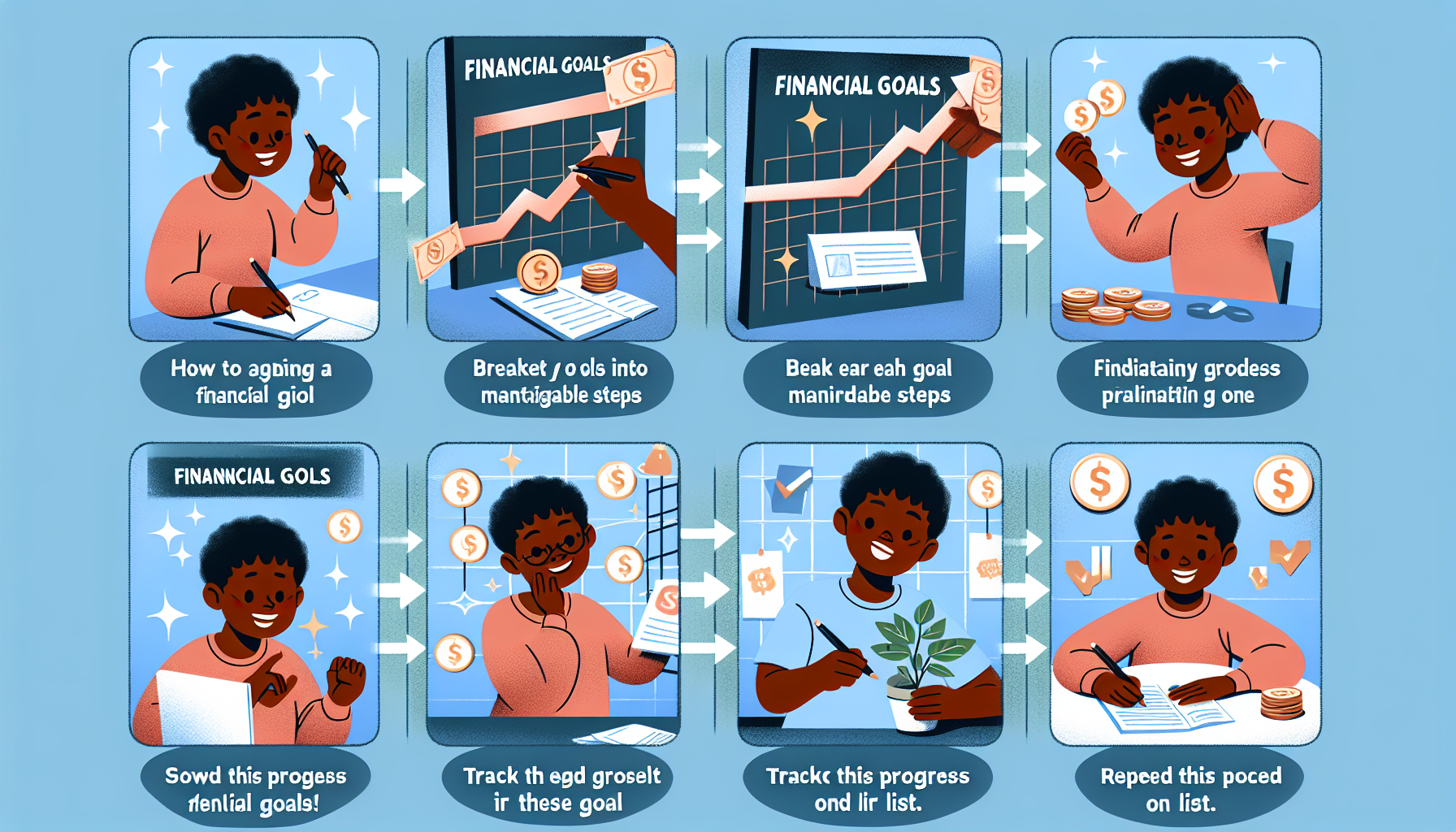

3. How to Set Effective Financial Goals

The key to achieving financial success is setting goals that are SMART:

- Specific: Define your goal clearly. Instead of saying “save money,” specify “save $10,000 for a down payment.”

- Measurable: Set a quantifiable target to track progress.

- Achievable: Ensure your goal is realistic based on your current income and expenses.

- Relevant: Align goals with your life priorities and values.

- Time-bound: Set a deadline to create urgency and accountability.

4. Steps to Achieve Your Financial Goals

1. Assess Your Current Financial Situation

- Track your income, expenses, and debts.

- Identify areas where you can cut unnecessary spending.

2. Create a Budget

- Allocate a portion of your income toward savings and debt repayment.

- Use tools like apps or spreadsheets to monitor your budget regularly.

3. Prioritize Your Goals

- Focus on high-priority goals like paying off high-interest debt or building an emergency fund.

- Balance short-term and long-term goals to avoid neglecting any area.

4. Build an Emergency Fund

- Save 3-6 months’ worth of living expenses to cover unexpected situations.

5. Automate Your Savings

- Set up automatic transfers to a dedicated savings account to stay consistent.

6. Invest Wisely

- Consider low-risk investments for short-term goals and higher-risk, higher-reward options for long-term objectives.

- Research options like mutual funds, ETFs, or cryptocurrencies.

7. Monitor and Adjust

- Review your progress every few months.

- Adjust your plan based on changes in income, expenses, or life circumstances.

5. Common Mistakes to Avoid

- Setting vague goals: Be as specific as possible.

- Overlooking inflation: Factor inflation into long-term savings plans.

- Ignoring professional advice: Consult a financial advisor if needed.

- Failing to celebrate milestones: Recognize your achievements to stay motivated.

Conclusion

Setting financial goals and achieving them is a journey that requires discipline, planning, and a willingness to adapt. By following the steps outlined above, you can take control of your finances and create a brighter future for yourself and your loved ones.

For more tips and insights, stay tuned to Invettor.com—your trusted source for financial advice and strategies. We help you make informed decisions to reach financial freedom and make the most out of your money.

Looking for more guidance? Check out my YouTube channel for detailed discussions on personal finance, savings strategies, and investment tips. Let’s make financial freedom a reality together!