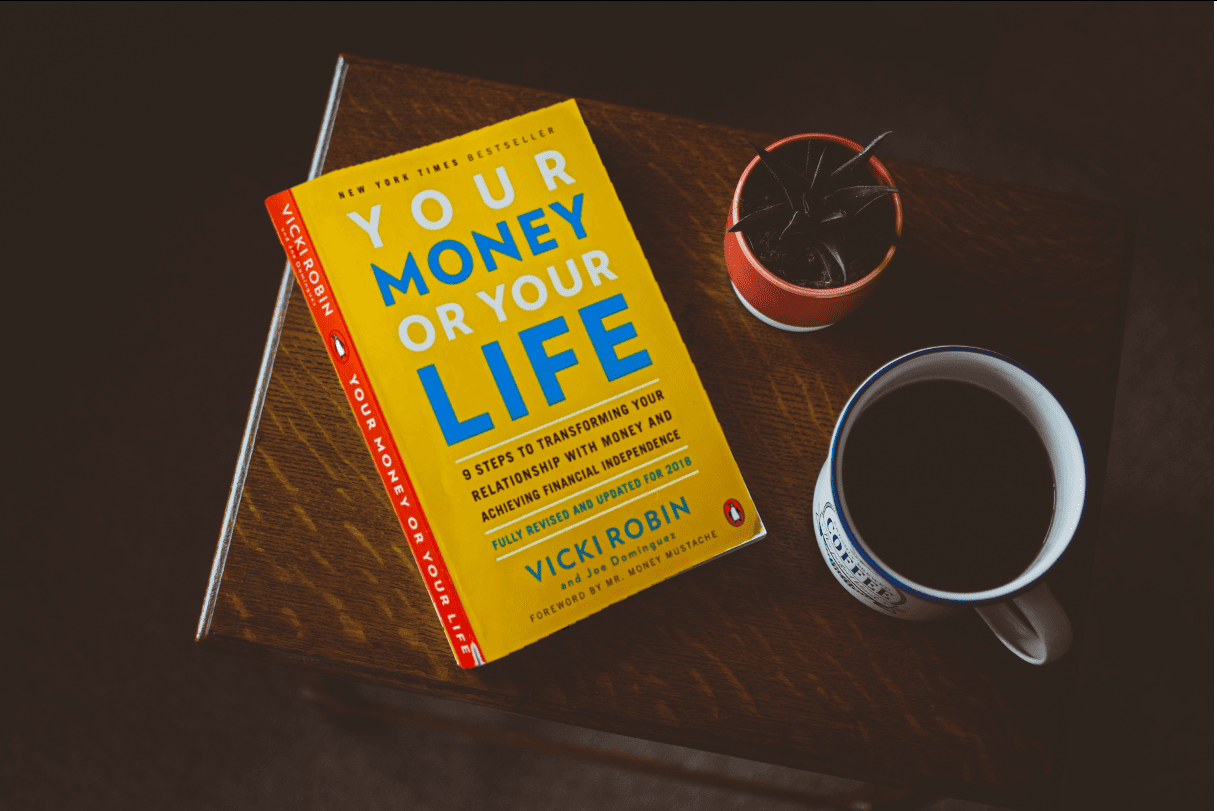

If you’re searching for a blueprint to achieve financial independence while redefining your relationship with money, Your Money or Your Life by Vicki Robin and Joe Dominguez may be the transformative guide you need. This personal finance classic has been updated and re-released multiple times, reflecting its timeless principles on mindful spending, life energy, and the pursuit of true financial freedom.

Quick Overview

- Title: Your Money or Your Life

- Authors: Vicki Robin & Joe Dominguez

- First Published: 1992 (revised editions in later years)

- Main Focus: A 9-step program to transform your relationship with money, achieve financial independence, and live more consciously.

Unlike many personal finance books that focus on making more money, Your Money or Your Life encourages readers to evaluate how they spend both money and time. By viewing money as life energy, the authors prompt a profound shift in how we work, save, and plan for the future.

5 Key Takeaways

- Track Every Penny

- Concept: Know exactly where your money goes each month.

- Why It Matters: This transparency helps you understand your spending habits and prioritize what truly adds value to your life.

- Redefine the Value of Money

- Concept: Money equals the time and energy you spend earning it—so spend it wisely.

- Why It Matters: When you treat money as life energy, you become more intentional and less impulsive in your financial decisions.

- Find Your “Enough”

- Concept: Instead of constantly craving more, determine how much money is sufficient for a comfortable, meaningful life.

- Why It Matters: Understanding “enough” keeps you from overspending and chasing endless financial goals that don’t increase happiness.

- Achieve Financial Independence

- Concept: Save and invest your money until you have enough returns to cover your living expenses.

- Why It Matters: Financial independence frees you to pursue work or passions that truly fulfill you, rather than those that merely pay the bills.

- Align Spending with Values

- Concept: Spend on things and experiences that reflect your life’s priorities, and cut out the rest.

- Why It Matters: Value-based spending helps you derive greater satisfaction from your money—and reduces wasteful expenses.

Who Should Read “Your Money or Your Life”?

- Budget Conscious Readers: If you’re ready to track every penny, this book offers a detailed, step-by-step approach.

- Minimalists & Sustainability Advocates: The message of living within your means and reducing material consumption resonates strongly with those seeking a simpler lifestyle.

- FIRE Enthusiasts: The Financial Independence, Retire Early movement considers this book foundational reading, as it directly inspired many FIRE principles.

- Anyone Reevaluating Work-Life Balance: If you feel trapped in a job just to pay bills, this book helps you find new motivations and potentially design a more fulfilling life.

Personal Reflection

When I first read Your Money or Your Life, the concept of treating money as “life energy” was a revelation. Suddenly, that quick $5 latte or mindless online purchase felt like trading valuable hours of my life for fleeting satisfaction. By diligently tracking my spending for a few months, I realized how much money was going toward things I didn’t genuinely value. Implementing just a few of the book’s steps led to saving more consistently and redirecting funds toward activities that truly bring me joy—travel, quality time with friends, and investing in my future.

Ready to Transform Your Relationship with Money?

Begin your journey toward financial independence and a more conscious life today.

Final Thoughts

Your Money or Your Life is more than a budget book—it’s a radical wake-up call to rethink how you exchange your time for money. If you’re willing to closely examine your spending habits, adopt a more mindful approach to earning, and define what “enough” really means, you’ll discover a path to freedom that’s both financially secure and deeply fulfilling.