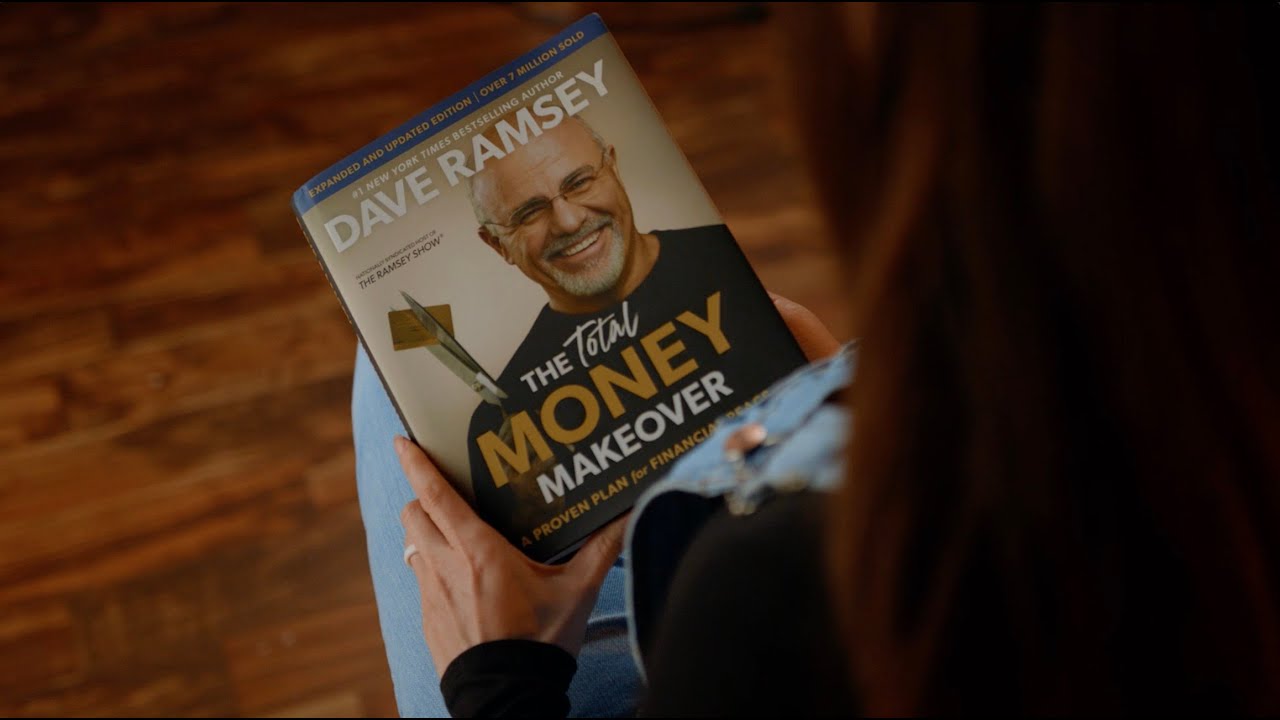

If you’ve ever felt overwhelmed by credit card bills or lived paycheck to paycheck, The Total Money Makeover by Dave Ramsey offers a clear, step-by-step guide to help you regain control of your finances. Below is a concise summary of this popular personal finance bestseller, packed with key takeaways, reasons to read it, and multiple links to grab your own copy.

Quick Overview

- Title: The Total Money Makeover: A Proven Plan for Financial Fitness

- Author: Dave Ramsey

- First Published: 2003

- Main Focus: Practical, disciplined steps (the “Baby Steps”) for getting out of debt and building financial security.

Dave Ramsey’s no-nonsense approach to budgeting and debt payoff is built around his famous “Baby Steps.” By starting with a starter emergency fund and progressing toward early retirement and wealth-building, you’ll have a roadmap for every stage of your financial journey.

5 Key Takeaways

- Build a Starter Emergency Fund

- Concept: Save $1,000 (or more, if your income is higher) as quickly as possible.

- Why It Matters: Helps you avoid taking on new debt when faced with unexpected expenses.

- Use the Debt Snowball

- Concept: List your debts from smallest to largest, and pay them off in that order.

- Why It Matters: Early “wins” keep you motivated and momentum grows as you tackle bigger debts.

- Fully Fund Your Emergency Savings

- Concept: Once high-interest debt is cleared, aim for 3–6 months of living expenses in savings.

- Why It Matters: Provides long-term security and peace of mind against job loss or economic downturns.

- Invest for the Future

- Concept: Put 15% of your income into retirement accounts (401(k), IRA, etc.) once debt-free.

- Why It Matters: Compound interest accelerates your wealth-building over time.

- Pay Cash for Major Expenses

- Concept: Pay cash for big-ticket items like cars and aggressively pay down mortgage debt.

- Why It Matters: Living debt-free frees up more money for giving, investing, and living on your own terms.

Who Should Read “The Total Money Makeover”?

- Debt-Ridden Individuals: If you’re juggling multiple credit cards, auto loans, or student debt, this book maps out a realistic plan to eliminate them.

- Beginner Budgeters: Ramsey’s system is accessible, even if you have zero prior budgeting experience.

- Families & Couples: Learn to set shared financial goals, reduce money-related arguments, and save for the future together.

- Anyone Seeking Discipline: If you struggle with impulse spending, this book’s straightforward approach helps build stronger financial habits.

Personal Reflection

When I first read The Total Money Makeover, I was buried in credit card debt and had barely any savings. Ramsey’s “Baby Steps” gave me a clear blueprint: start with a small emergency fund, then clear debts one by one using the debt snowball method. Every time I paid off a debt, I celebrated a small victory—and that drove me to tackle the next one. Today, I’m more confident in handling my money and have started investing for my long-term goals.

Ready to Transform Your Financial Life?

Final Thoughts

The Total Money Makeover stands out for its simple, proven strategy. It has helped millions of people get out of debt, build savings, and find financial peace. If you’re tired of living paycheck to paycheck, or feeling weighed down by credit card balances, this book can be the turning point you need. With disciplined action and Ramsey’s guiding steps, you’ll be on a path to a healthier financial future.