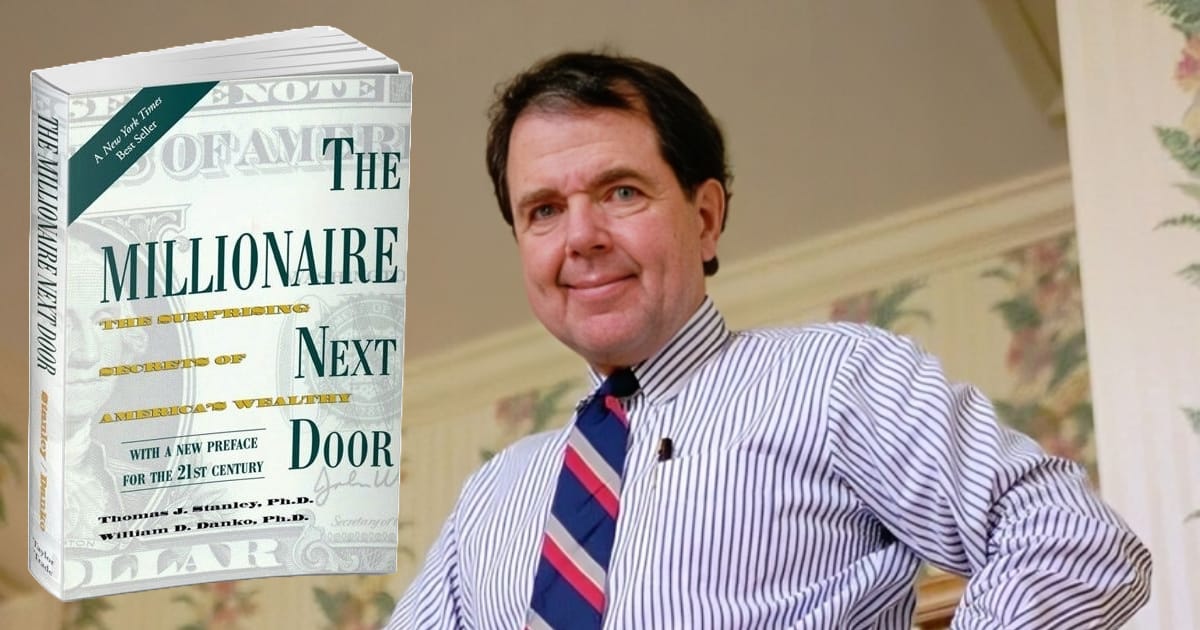

When you think of “millionaires,” you might imagine flashy cars, designer clothes, and extravagant homes. The Millionaire Next Door by Thomas J. Stanley and William D. Danko challenges these stereotypes, revealing that many truly wealthy individuals live surprisingly modest lives. This groundbreaking study shattered myths about wealth when it was first published—and continues to guide readers toward more responsible and effective money habits.

Quick Overview

- Title: The Millionaire Next Door

- Authors: Thomas J. Stanley & William D. Danko

- First Published: 1996

- Main Focus: Revealing the common traits, habits, and lifestyles of self-made millionaires in the United States.

Instead of profiling celebrities or trust-fund heirs, Stanley and Danko investigated everyday millionaires—people who quietly amassed significant wealth through disciplined saving, investing, and living below their means. Their book highlights why it’s more important to be rich than to just appear rich.

5 Key Takeaways

- They Live Below Their Means

- Concept: The typical millionaire is frugal and prioritizes saving over conspicuous consumption.

- Why It Matters: High income doesn’t automatically result in wealth—consistent saving and sensible spending do.

- They Budget and Track Expenses

- Concept: Even with substantial net worth, most millionaires keep a budget to allocate funds effectively.

- Why It Matters: A budget is the foundation of financial discipline and helps prevent lifestyle creep.

- They Invest Consistently

- Concept: Building wealth often involves putting money into stocks, bonds, real estate, or businesses over time.

- Why It Matters: Compound interest can significantly grow wealth when consistently leveraged.

- They Focus on Net Worth, Not Income

- Concept: True financial security is determined by what you keep (assets minus liabilities), not just your salary.

- Why It Matters: Earning a high salary but having high expenses often leads to minimal or no wealth accumulation.

- They Value Financial Independence Over Social Status

- Concept: Many millionaires avoid expensive status symbols and instead devote resources to freedom and long-term security.

- Why It Matters: When you prioritize independence over appearances, you’re more likely to develop sustainable wealth.

Who Should Read “The Millionaire Next Door”?

- Aspiring Savers: If you’re just starting out on your financial journey and need proof that modest living pays off in the long run.

- High Earners Struggling to Save: Those who want to break the cycle of paycheck-to-paycheck living—despite having a solid income.

- Frugality Enthusiasts: The book’s insights validate the idea that living below your means is a tested path to wealth.

- Anyone Curious About Real Wealth: If you want to distinguish between the showy “rich” and the quietly affluent, this is your must-read.

Personal Reflection

Reading The Millionaire Next Door changed the way I measure success. Instead of equating wealth with flashy cars or expensive vacations, I began focusing on net worth and long-term financial security. I started tracking expenses more diligently, cut down on unnecessary indulgences, and redirected those funds into investments. Over time, these small shifts helped me establish a more stable and optimistic financial footing.

Ready to Discover the Secrets of America’s Wealthy?

Whether you’re just starting out or already have a solid financial plan, there’s always more to learn about adopting a millionaire mindset.

Final Thoughts

The Millionaire Next Door is a critical read for anyone eager to understand the ordinary behaviors that yield extraordinary results over time. By focusing on frugality, smart budgeting, and consistent investing, you can gradually build a life of true financial freedom—no gaudy displays necessary. The book’s enduring popularity is a testament to its core message: real wealth often resides in the unlikeliest of places—maybe even right next door.