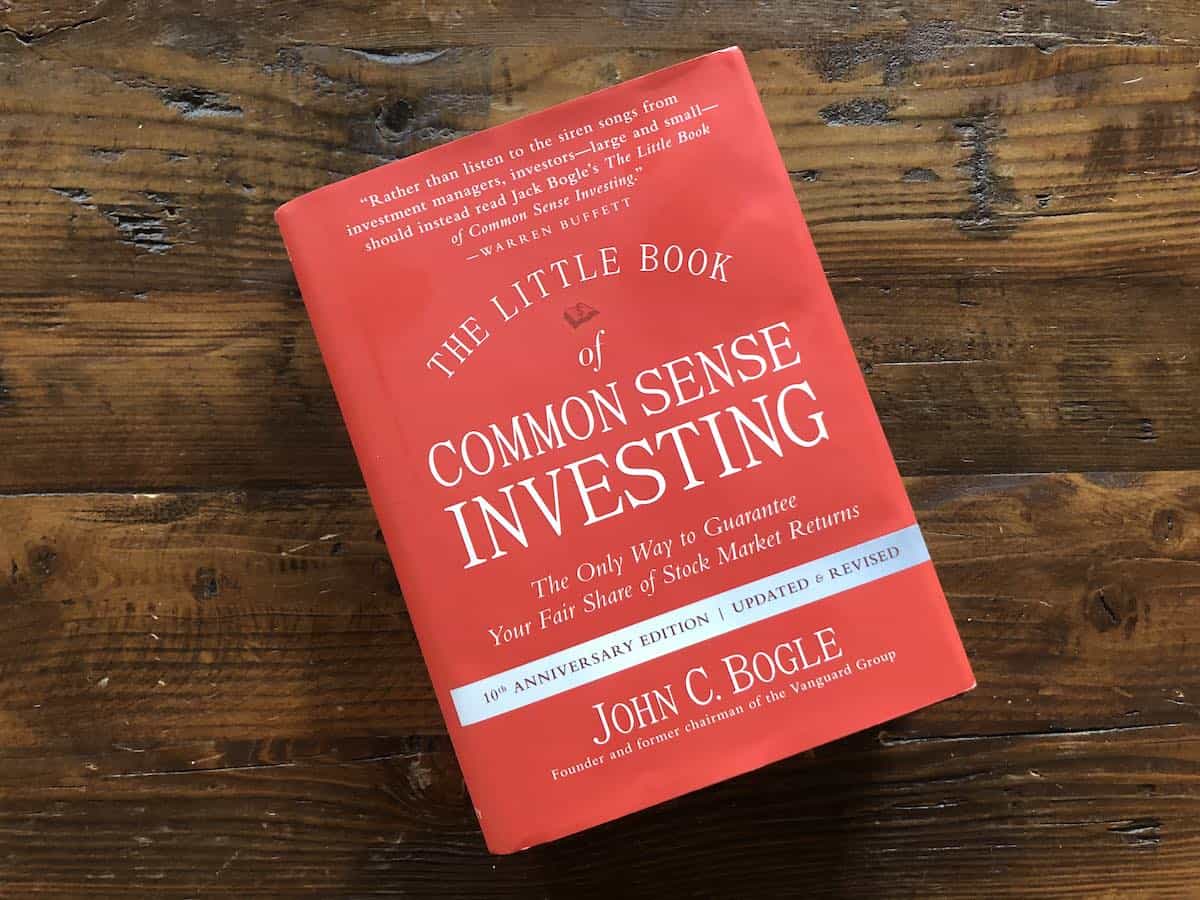

If you’re weary of complex stock-picking strategies, high mutual fund fees, and the emotional roller coaster of market timing, The Little Book of Common Sense Investing by John C. Bogle offers a straightforward, data-driven alternative. Widely regarded as the father of index investing, Bogle explains why most investors are better off using low-cost index funds to capture the overall market’s gains—without the stress or risk of trying to outperform it.

Quick Overview

- Title: The Little Book of Common Sense Investing

- Author: John C. Bogle

- First Published: 2007 (with updated editions)

- Main Focus: Advocating for low-cost, long-term investing via broad-market index funds

Bogle’s central premise is that cost matters—a lot. High expense ratios and frequent trading can significantly eat into your returns, making it challenging for active strategies to outperform the market in the long run. Instead, he recommends buying and holding index funds that track major benchmarks (like the S&P 500), thus minimizing fees and maximizing compounding potential.

5 Key Takeaways

- Cost Is the Biggest Drag on Returns

- Concept: High management fees and trading costs eat into your profits more than you might realize.

- Why It Matters: Even a 1% difference in fees, compounded over decades, can lead to significantly less money in your pocket.

- Broad Diversification Reduces Risk

- Concept: Index funds that track the entire market ensure you own a slice of hundreds (or thousands) of companies.

- Why It Matters: Spreading your risk prevents a single stock or sector downturn from derailing your entire portfolio.

- The Power of Compounding

- Concept: Reinvesting dividends and capital gains allows your money to grow exponentially over time.

- Why It Matters: Small, steady contributions snowball into substantial wealth, provided you stay invested for the long haul.

- Buy and Hold Outperforms Market Timing

- Concept: Trying to predict market highs and lows often leads to lower returns than simply remaining invested.

- Why It Matters: Consistency and patience generally trump emotional reactions to short-term volatility.

- Investor Behavior Matters

- Concept: Emotional errors, like panic selling or chasing hot stocks, typically undermine your long-term results.

- Why It Matters: A calm, disciplined approach keeps you on track when markets swing wildly.

Who Should Read “The Little Book of Common Sense Investing”?

- New Investors: If you’re overwhelmed by countless fund options and stock tips, Bogle’s strategy brings clarity and ease.

- Long-Term Retirement Planners: Low-cost index funds are well-suited for IRAs, 401(k)s, and other retirement accounts.

- Cost-Conscious Savers: Anyone who wants to minimize fees and maximize compounding will appreciate Bogle’s focus on cost efficiency.

- Seasoned Investors Needing Simplicity: If your portfolio feels too complicated or high-maintenance, this book serves as a helpful refresher on time-tested fundamentals.

Personal Reflection

Before reading Bogle’s work, my investment approach involved juggling several actively managed mutual funds—with fees I barely noticed until I did the math. Embracing a low-cost, index-focused strategy transformed my portfolio and my peace of mind. I stopped worrying about beating the market and started letting compounding do the heavy lifting. The result? Less stress, fewer fees, and more consistent growth over time.

Ready to Simplify Your Investment Strategy?

If you’re eager to adopt a calmer, more cost-effective method of building wealth, it’s time to explore John C. Bogle’s enduring wisdom.

Final Thoughts

Decades after its publication, The Little Book of Common Sense Investing remains one of the most influential guides for everyday investors. Bogle’s emphasis on low fees, broad diversification, and long-term discipline underpins many successful portfolios today. If you’re ready to break free from the noise of stock-picking and market-timing schemes, this book delivers a pragmatic blueprint for steady, reliable wealth accumulation.