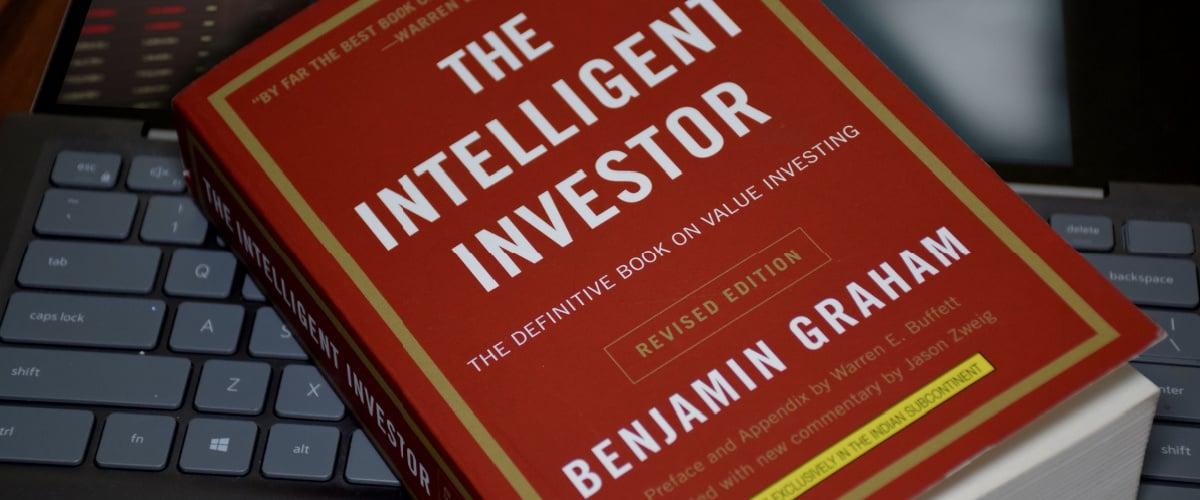

If you’re serious about investing and want foundational knowledge that transcends market fluctuations, The Intelligent Investor by Benjamin Graham should be at the top of your reading list. Known as the “father of value investing,” Graham lays out fundamental principles that legendary investors—most famously Warren Buffett—have used to consistently outperform average market returns.

Quick Overview

- Title: The Intelligent Investor

- Author: Benjamin Graham

- First Published: 1949 (Revised Editions in Later Years)

- Main Focus: Value investing, emotional discipline, and the concept of “margin of safety.”

Rather than chasing hot stocks or timing the market, Graham advocates a methodical, research-based strategy that relies on deep analysis of a company’s fundamentals. This “value investing” approach aims to buy shares at prices significantly lower than their intrinsic value, providing a cushion (or “margin of safety”) against losses.

5 Key Takeaways

- Margin of Safety

- Concept: Purchase stocks at a price substantially below their actual worth.

- Why It Matters: This buffer helps protect your investments if market conditions sour or company earnings dip.

- Mr. Market

- Concept: Personifying the market as an emotional partner who offers daily buy or sell prices that may or may not align with reality.

- Why It Matters: Teaches investors to take advantage of irrational pricing instead of being controlled by it.

- Investing vs. Speculating

- Concept: True investing is based on thorough analysis, adequate diversification, and reasonable expectations for returns—not short-term bets.

- Why It Matters: It sets a disciplined framework that avoids the high risks associated with speculation and market timing.

- Emotion vs. Logic

- Concept: Successful investors need to remove emotion from their decisions and stick to rational analysis.

- Why It Matters: Emotional reactions to market volatility often lead to poor investment choices, such as panic selling or buying into hype.

- Long-Term Perspective

- Concept: Holding investments long enough to ride out short-term market fluctuations allows time for intrinsic value to be realized.

- Why It Matters: Patience and consistency often outperform reactionary trading based on market headlines.

Who Should Read “The Intelligent Investor”?

- Beginner & Intermediate Investors: If you’re just starting or looking to refine your approach, Graham’s principles form a solid foundation.

- Value Investing Enthusiasts: Anyone interested in the Warren Buffett-style of investing will discover the original blueprint here.

- Long-Term Planners: If you prioritize steady, sustainable growth over quick wins, Graham’s strategies are tailor-made for you.

- Market Skeptics: Those wary of market hype can gain a disciplined framework to separate genuine opportunities from fads.

Personal Reflection

When I first delved into The Intelligent Investor, the idea of “Mr. Market” resonated with me the most. Viewing daily stock price movements as an emotional, often irrational character reframed how I respond to market fluctuations. Instead of panicking over a dip or jumping on a sudden spike, I learned to assess whether the price accurately reflects a company’s long-term fundamentals. By applying Graham’s margin of safety principle, I’ve been able to avoid several speculative pitfalls and build a more stable investment portfolio.

Ready to Invest Smarter?

If you’re eager to develop a disciplined, research-backed strategy, The Intelligent Investor provides the roadmap you need for long-term success.

Final Thoughts

Decades after its initial publication, The Intelligent Investor remains a go-to guide for serious investors worldwide. Its emphasis on rational decision-making, patience, and fundamental analysis shields readers from the traps of speculation. Whether you’re just starting out or fine-tuning your portfolio, this classic’s wisdom will serve as an invaluable compass on your investing journey.