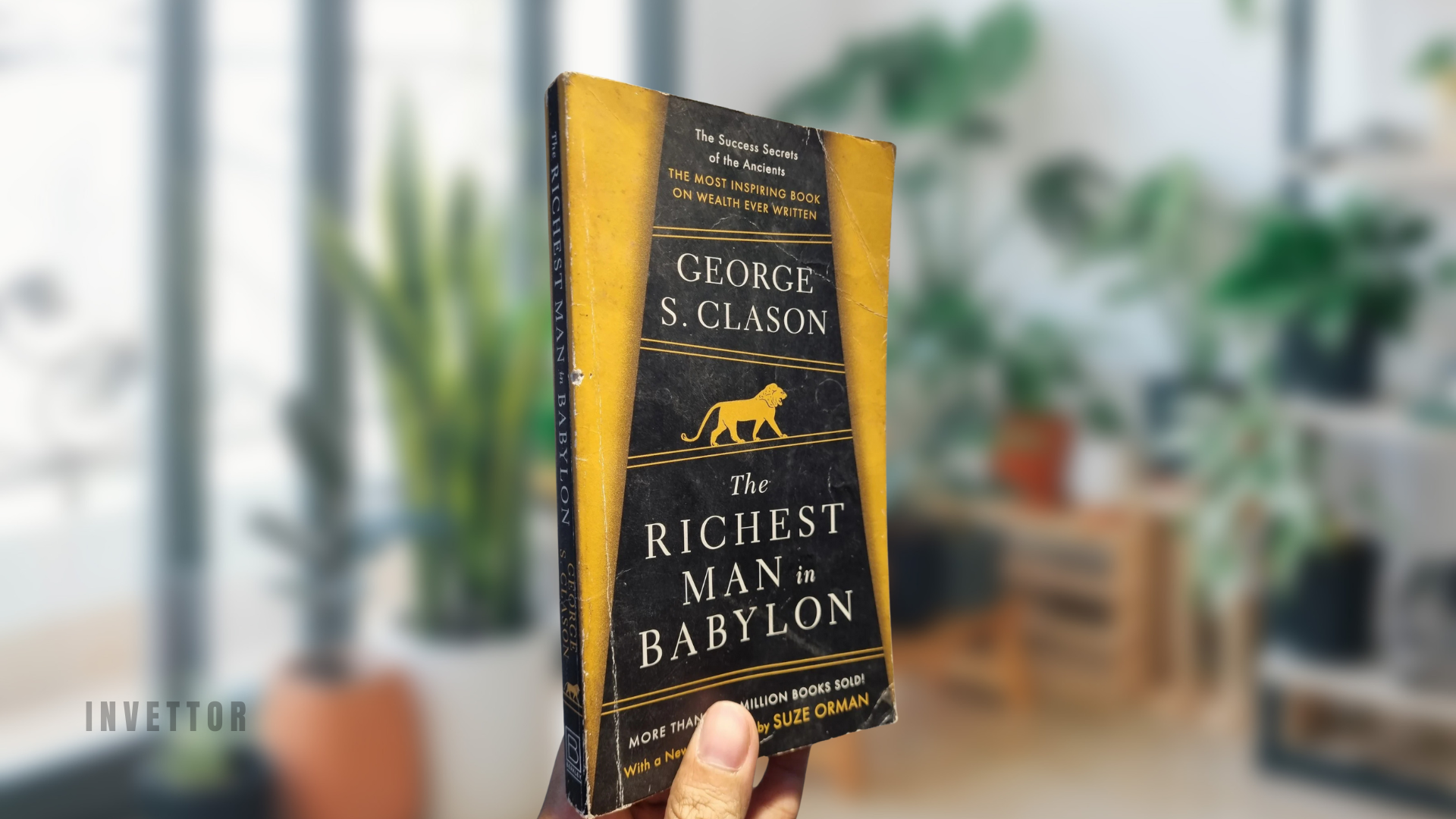

The Richest Man in Babylon by George S. Clason shares a collection of engaging parables set in ancient Babylon, each illustrating fundamental money-management principles. First published in 1926, it has become a classic for anyone seeking insight into saving, investing, and cultivating a mindset of abundance.

Quick Overview

- Title: The Richest Man in Babylon

- Author: George S. Clason

- First Published: 1926

- Main Focus: Demonstrating the enduring power of basic financial habits like saving, budgeting, and wise investing through short, relatable stories

Clason’s timeless tales revolve around characters who learn to break free from debt, accumulate wealth, and secure lasting prosperity. The book’s simple yet powerful messages have influenced generations of readers, offering practical lessons that remain highly relevant in today’s modern economy.

5 Key Takeaways

- Pay Yourself First

Concept: Set aside at least 10% of your income before addressing other expenses.

Why It Matters: Consistent saving builds the foundation for future investments and financial security. - Live Below Your Means

Concept: Avoid unnecessary spending and budget wisely to keep expenses in check.

Why It Matters: Controlling outflows leaves more room for saving and investing, accelerating wealth-building. - Seek Wise Counsel

Concept: Learn from those who have achieved financial success and avoid dubious schemes.

Why It Matters: Experienced advisors can help you make prudent decisions, preventing costly errors. - Invest for the Long Term

Concept: Grow your savings by putting them to work in safe, lucrative ventures.

Why It Matters: Over time, sound investments compound, significantly multiplying your initial capital. - Protect Your Wealth

Concept: Be cautious with new opportunities and thoroughly research them before committing funds.

Why It Matters: Avoiding reckless gambles safeguards the nest egg you’ve worked so hard to build.

Who Should Read “The Richest Man in Babylon”?

- Financial Newcomers: The concise parables provide a gentle introduction to budgeting and investing.

- Seasoned Savers: Those looking to revisit core money principles will find these lessons a helpful reminder.

- Anyone Seeking Time-Tested Advice: Basic financial truths remain constant, and Clason’s stories beautifully illustrate them.

Personal Reflection

When I first encountered The Richest Man in Babylon, I was surprised by how entertaining and straightforward the parables were—despite being set in ancient times. The principle of “paying yourself first” and the reminder to consistently save a portion of your earnings resonated deeply. Seeing how these basic rules of finance have guided countless generations reinforces that wealth-building, at its core, is about discipline, patience, and practical wisdom.

Ready to Unlock Ancient Wisdom for Modern Finance?

Clason’s parables prove that simple, consistent habits truly stand the test of time. By internalizing these key lessons, you can pave the way for sustainable wealth and long-term financial security—no matter the era.

Final Thoughts

Packed with powerful yet easily digestible messages, The Richest Man in Babylon offers more than an economic blueprint; it encourages a mindset shift toward discipline, optimism, and prudent decision-making. Whether you’re wrestling with debt, aiming for financial independence, or just need a refresher, these enduring parables can help you cultivate a healthier, more confident approach to money management.