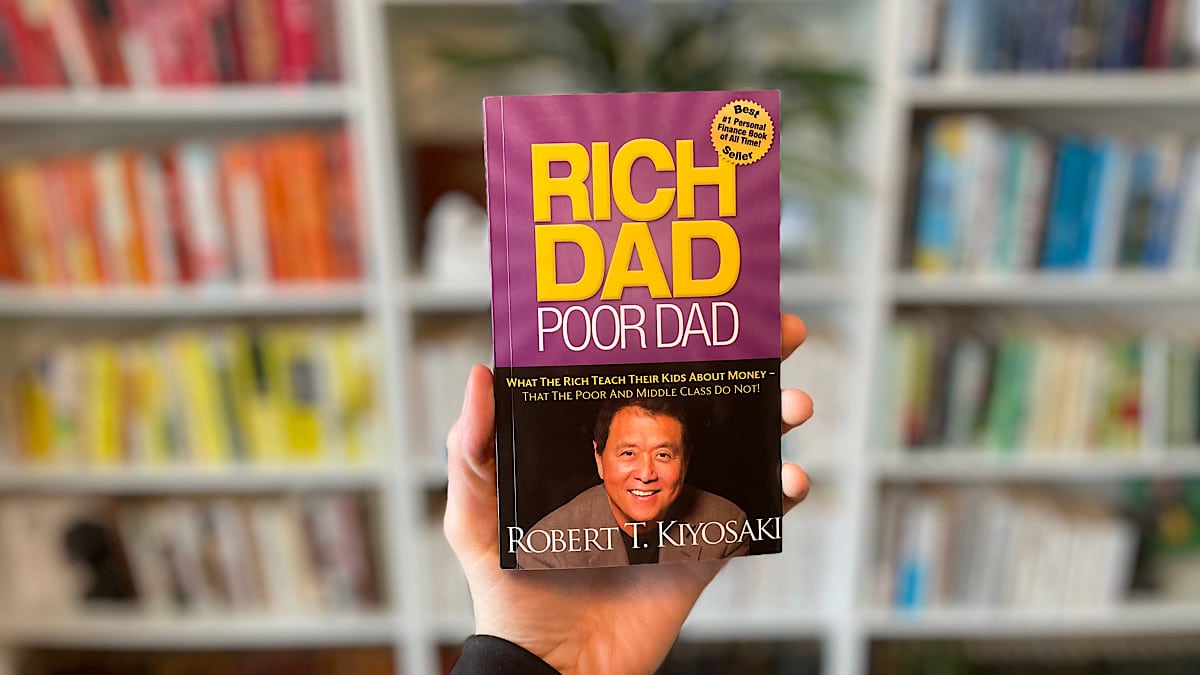

If you’re looking to shift your perspective on wealth, break away from the traditional 9-to-5 grind, and start building true financial independence, Rich Dad Poor Dad by Robert T. Kiyosaki is the book to pick up next. Below you’ll find a concise summary of this personal finance classic, along with key takeaways, who should read it, and a direct link to grab a copy for yourself.

Quick Overview

- Author: Robert T. Kiyosaki

- Publication Date: 1997

- Primary Focus: Understanding the difference between assets and liabilities, fostering an entrepreneurial mindset, and challenging conventional beliefs about money.

Kiyosaki uses a contrast between two father figures: his own highly educated (but financially struggling) “poor dad” and his best friend’s enterprising (but less formally educated) “rich dad.” Through their lessons, he illustrates how conventional education often lacks real-world financial teachings and how adopting the mindset of the “rich dad” can help anyone break the paycheck-to-paycheck cycle.

5 Key Takeaways

- Assets vs. Liabilities

- Core Concept: An asset puts money in your pocket, while a liability takes money out.

- Application: Focus on acquiring real assets—such as rental properties, stocks, or businesses—that generate recurring income.

- Mindset Shift

- Core Concept: Traditional schooling teaches you to be an employee, not an entrepreneur or investor.

- Application: Question the idea that you must “get a good job” to be financially secure. Instead, explore paths like business ownership or real estate investing.

- Financial Literacy Is Key

- Core Concept: Understanding basic accounting, tax strategies, and market trends gives you a competitive edge.

- Application: Continuously invest in your financial education through books, workshops, and practical experience.

- Work to Learn, Not Just to Earn

- Core Concept: Early in your career, focus on developing crucial skills (sales, marketing, investing) rather than chasing the highest paycheck.

- Application: Seek opportunities that challenge you and help you grow—this will pay off more than a slightly higher salary in the long run.

- Take Action & Learn from Mistakes

- Core Concept: Real-world experience is the best teacher, and losing money can be a stepping stone to success if you learn from it.

- Application: Start small with an investment or side hustle, and iterate as you gain more knowledge.

Who Should Read “Rich Dad Poor Dad”?

- Aspiring Entrepreneurs: If you dream of owning your own business or exploring investment opportunities but don’t know where to begin, this book lays the groundwork.

- Beginners to Personal Finance: New to terms like assets, liabilities, or net worth? Kiyosaki breaks down these concepts in simple language.

- 9-to-5 Employees Looking for More: For anyone stuck in a comfort zone, looking for ways to generate additional income, Rich Dad Poor Dad offers a mindset shift.

- Parents & Educators: Those who want to pass down better financial lessons to the next generation will find the book’s parable-style approach invaluable.

Why This Book Stands Out

- Storytelling Approach: Rather than dry financial jargon, Kiyosaki teaches through relatable anecdotes and conversations, making complex topics easier to grasp.

- Challenges the Status Quo: It questions the mainstream “go to school, get a job, retire at 65” narrative that might no longer fit the modern world.

- Long-Lasting Influence: Published over two decades ago, it continues to top best-seller lists and spark debates in the personal finance community—an indication of its evergreen appeal.

Personal Reflection

I remember picking up Rich Dad Poor Dad when I was still juggling debts and unsure of how to manage my paycheck. The book’s simplest message—understand the difference between an asset and a liability—completely changed how I approached my day-to-day financial decisions. Instead of asking “Can I afford this new car payment?” I started asking, “Will this purchase generate cash flow or take cash away?” This single shift altered my spending and investing habits, ultimately setting me on a more secure financial path.

Ready to Dive In?

Rich Dad Poor Dad has helped millions of readers realize that wealth-building isn’t just for the “lucky” or the “inherited.” With the right mindset, skills, and continuous learning, anyone can start growing their financial future.

Final Thoughts

If you’re serious about breaking free from the 9-to-5 grind, eliminating debt, or leveling up your financial literacy, Rich Dad Poor Dad is a must-read. It offers foundational principles that apply universally—whether you’re looking to invest in real estate, start a side business, or simply save more effectively.

Feel free to share your biggest takeaway after reading the book. Happy wealth-building!