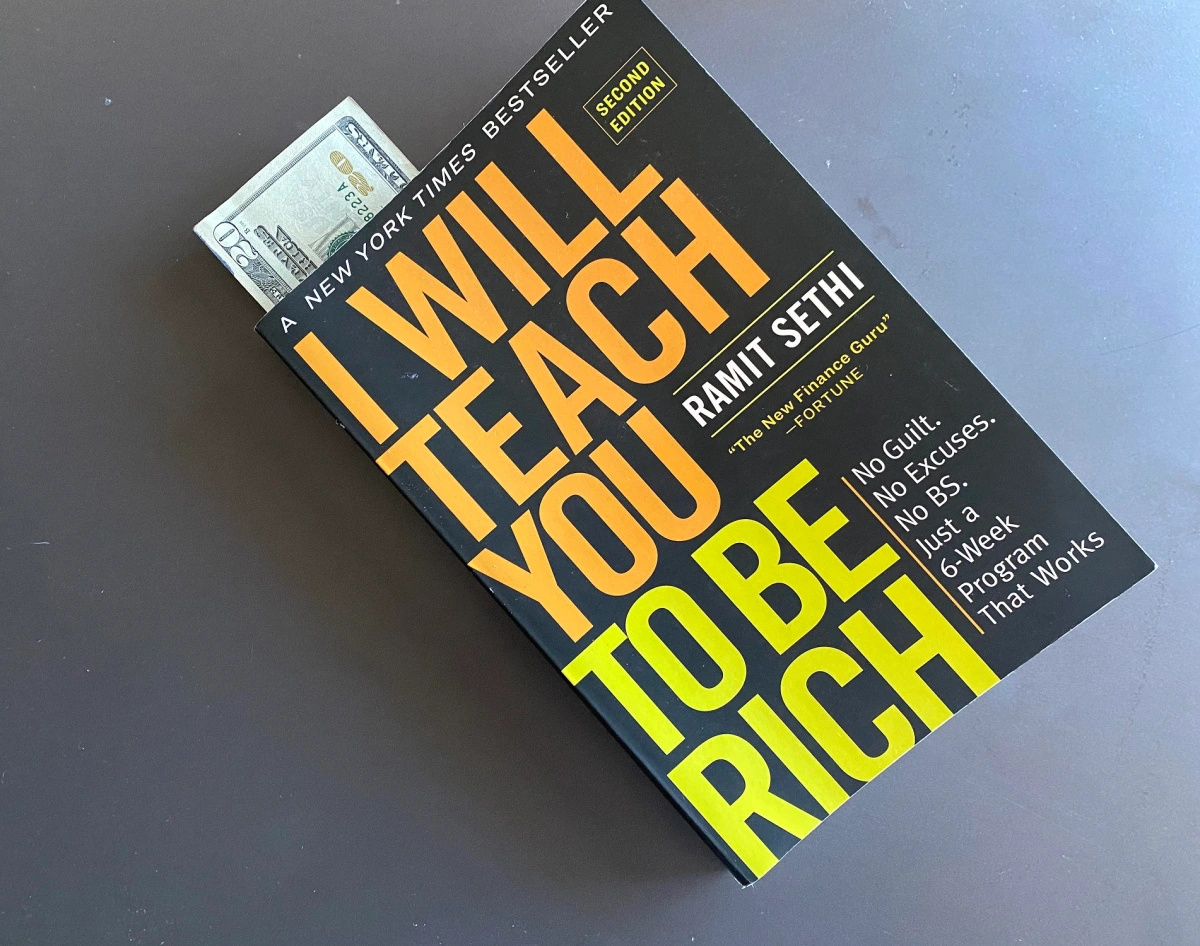

If you’re ready to stop pinching pennies and start focusing on the “big wins” that truly grow your wealth, I Will Teach You to Be Rich by Ramit Sethi might just be the perfect game plan. In this personal finance bestseller, Sethi introduces a 6-week program designed to automate your money, optimize your bank accounts, negotiate like a pro, and build lasting wealth—without giving up the things you love.

Quick Overview

- Title: I Will Teach You to Be Rich

- Author: Ramit Sethi

- First Published: 2009 (updated edition released in 2019)

- Main Focus: A practical approach to earning more, spending consciously, and automating financial systems so you can live a “rich life” on your own terms.

Sethi tackles common financial topics like credit cards, bank fees, budgeting, and investing—but with a refreshing, direct tone. Rather than focusing on restrictive budgeting, he emphasizes automating and optimizing your finances so you can spend guilt-free on what actually brings you joy.

5 Key Takeaways

- Automation is Everything

- Concept: Set up your accounts to automatically distribute your paycheck to savings, bills, and investments.

- Benefit: Helps you save and invest consistently without having to rely on willpower or memory.

- Optimize Your Banking and Credit Cards

- Concept: Use high-interest savings accounts and rewards credit cards that offer the best perks while avoiding fees.

- Benefit: Keeps your day-to-day transactions efficient and can actually earn you money through interest and cashback.

- Focus on “Big Wins” Instead of Penny-Pinching

- Concept: Negotiate your rent, cut unwanted subscriptions, and invest for the long term—those moves can yield huge gains.

- Benefit: Allows you to spend on the things you love (like travel, dining out, or hobbies) without guilt, since you’ve already maximized your major financial decisions.

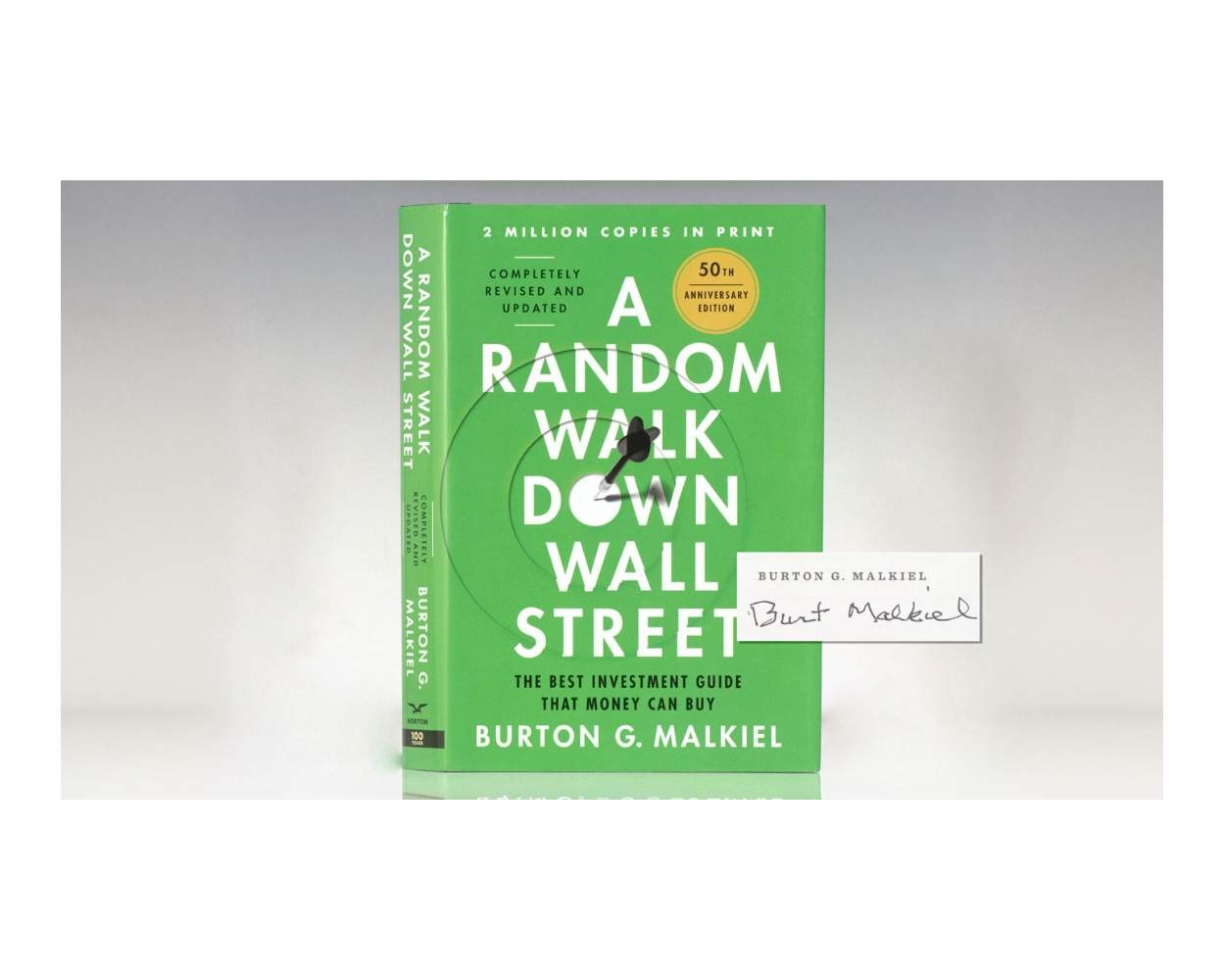

- Invest Early and Consistently

- Concept: Embrace long-term, low-cost index funds for retirement and brokerage accounts.

- Benefit: Compounding returns over time can significantly grow your wealth with minimal daily effort.

- Negotiate Salaries and Other Major Expenses

- Concept: Don’t be afraid to negotiate your salary, bills, and contracts—most prices are more flexible than you think.

- Benefit: Earning a higher income has a more dramatic impact on your financial health than incremental budget cuts.

Who Should Read “I Will Teach You to Be Rich”?

- Young Professionals: If you’re in your 20s or 30s and looking to build a solid financial foundation, Sethi’s 6-week plan is especially tailored for you.

- People Tired of Strict Budgets: Those who want a more flexible, guilt-free approach to money management will appreciate Sethi’s philosophy.

- Aspiring Investors: If you’re unsure where to begin with investing, the book provides straightforward advice on getting started with index funds.

- Anyone Seeking Practical Systems: Sethi offers step-by-step instructions on setting up automated finances, so even beginners can follow along.

Personal Reflection

When I first encountered I Will Teach You to Be Rich, I was struggling with maintaining a consistent savings plan. Ramit Sethi’s automation strategy was a total game-changer for me. By setting up direct deposits into separate accounts and ensuring credit card bills were paid automatically in full, I freed up mental bandwidth to focus on earning more and enjoying life. The book’s concept of “conscious spending” also helped me let go of the guilt around small indulgences—since my major financial moves were already working on autopilot.

Ready to Automate Your Finances?

If you’re prepared to cut through the noise of traditional penny-pinching methods and truly take control of your money, don’t wait any longer.

Final Thoughts

I Will Teach You to Be Rich remains a standout in the personal finance space for its mix of practical steps, relatable tone, and focus on living a “rich life” today—while still saving and investing for tomorrow. It’s a must-read for anyone wanting a clear, updated guide to money management that fits our modern, busy lives.