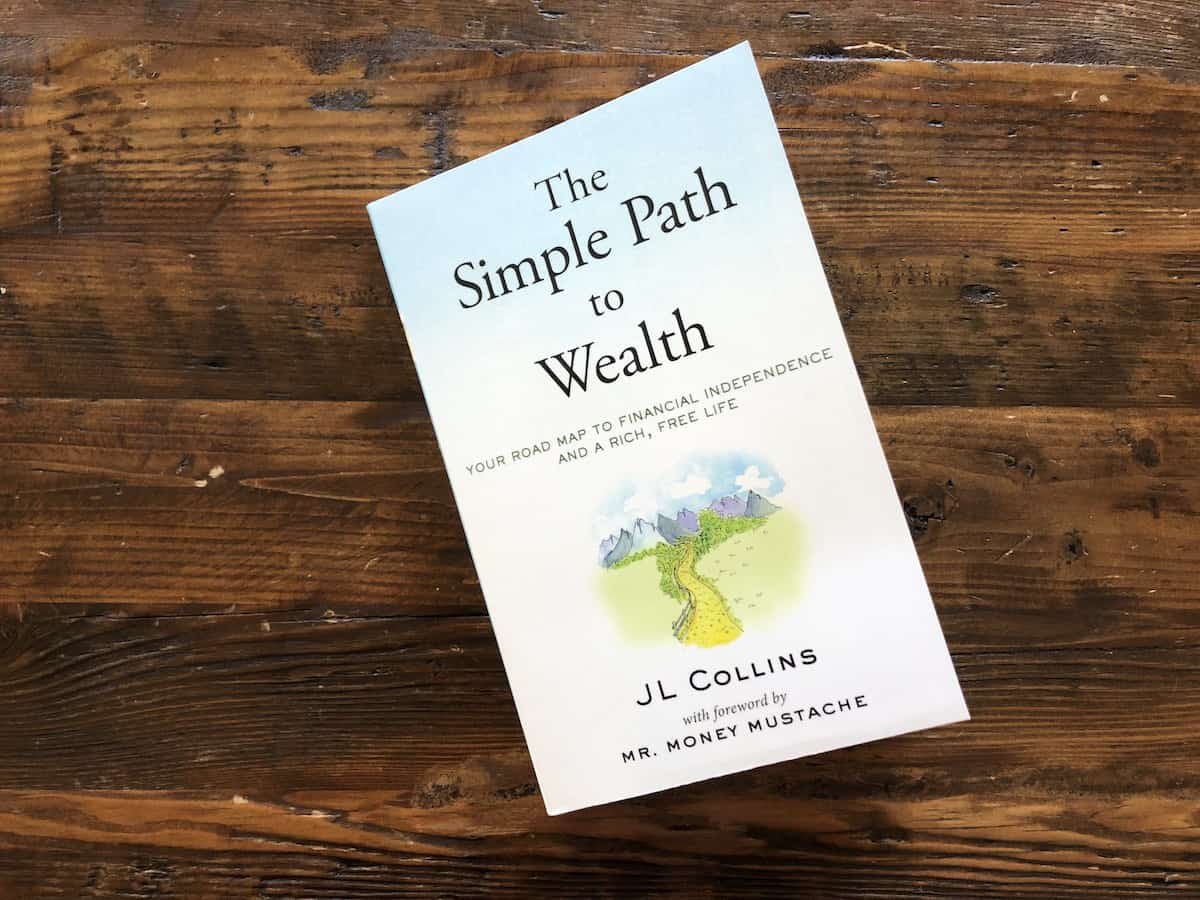

If you’ve been searching for an approachable, no-nonsense guide to building wealth—and eventually achieving financial freedom—The Simple Path to Wealth by JL Collins might be exactly what you need. Collins distills decades of experience and insights into a clear-cut strategy centered on low-cost index funds, debt elimination, and a concept he fondly refers to as “F-You Money.”

Quick Overview

- Title: The Simple Path to Wealth

- Author: JL Collins

- First Published: 2016

- Main Focus: Using the power of saving, simple investing strategies, and a long-term mindset to accumulate “F-You Money” (enough assets to break free from obligatory work)

Collins started sharing his financial wisdom through a series of blog posts aimed at his daughter—intended to guide her (and readers) toward financial security. This eventually evolved into The Simple Path to Wealth, a widely praised book in the personal finance community, especially among devotees of the Financial Independence, Retire Early (FIRE) movement.

5 Key Takeaways

- Live Below Your Means

Concept: Spending less than you earn is the foundational habit for wealth building.

Why It Matters: Lower expenses free up more money for saving and investing—critical for accelerating your financial growth. - Avoid (or Eliminate) Debt

Concept: Debt often comes with high interest rates that drag down your ability to invest and save.

Why It Matters: Getting rid of consumer debt (credit cards, high-interest loans) propels you forward on the path to financial freedom. - Invest Primarily in Low-Cost Index Funds

Concept: Collins advocates a simple portfolio—often just the Vanguard Total Stock Market Index Fund (VTSAX) for U.S. investors.

Why It Matters: Minimizing fees and diversifying across the entire market historically produces strong, predictable returns over time. - Adopt a Long-Term Mindset

Concept: Market fluctuations are inevitable, but consistent investing and holding through downturns pays off.

Why It Matters: Emotional trading or attempting to time the market often leads to lower returns and more stress. - F-You Money = Freedom

Concept: Having enough investments to cover your expenses means work becomes optional, not mandatory.

Why It Matters: True financial independence lets you choose how, when, and if you want to work—leading to greater personal fulfillment.

Who Should Read “The Simple Path to Wealth”?

- Beginner Investors: If you find traditional finance jargon overwhelming, Collins’ casual, storytelling style makes complex topics easy to digest.

- FIRE Enthusiasts: The Simple Path to Wealth is considered a staple among those seeking early retirement and lifestyle freedom.

- Anyone Drowning in Financial Advice: If you’re tired of conflicting recommendations from gurus, this book offers a single, coherent strategy.

- Seasoned Investors Wanting Simplicity: Even experienced investors can benefit from streamlining their portfolios into straightforward, index-focused setups.

Personal Reflection

Before reading The Simple Path to Wealth, I was constantly second-guessing my investment choices—bouncing between stock tips and trending mutual funds. Collins’ emphasis on a single, low-cost index fund portfolio not only simplified my investments but also freed up mental energy. Once I let go of trying to beat the market, I found more time to focus on other life goals, confident that my wealth-building “machine” was running smoothly in the background.

Ready to Embrace the Simple Path?

If you’re eager to cut through the noise and start building sustainable wealth, JL Collins’ no-frills approach might be just the road map you’ve been looking for.

Final Thoughts

At its core, The Simple Path to Wealth promotes a return to basics—spend less, save more, invest wisely, and stay the course. Whether you’re just beginning your financial journey or looking to refine an existing strategy, Collins’ advice serves as a powerful reminder that true wealth is built methodically over time. If financial independence and a more flexible lifestyle are on your radar, this book provides a practical, inspiring framework to get you there.